Are you an international buyer, thinking of purchasing a Paris property in 2018 with Agence Varenne? If so, you might be interested to know what’s

In the past 18 months, there have been three major events that, for French expatriates living abroad, make returning to France more attractive than ever.

Do you intend to buy a property in Paris in early 2018, whether that’s in Paris’s 8th arrondissement, the so-called ‘Golden Triangle’, or in St.

Excellent news if you intend to invest in a property in Paris in 2018! Whether you plan to buy a private mansion overlooking a beautiful

“It is through his passion for History and the Left Bank that Andréa proposes to make you discover this very beautiful apartment place Saint Sulpice”

Rive Droite, it is with pleasure that Xavier will accompany you with his eye of esthete in the discovery of this beautiful property facing the

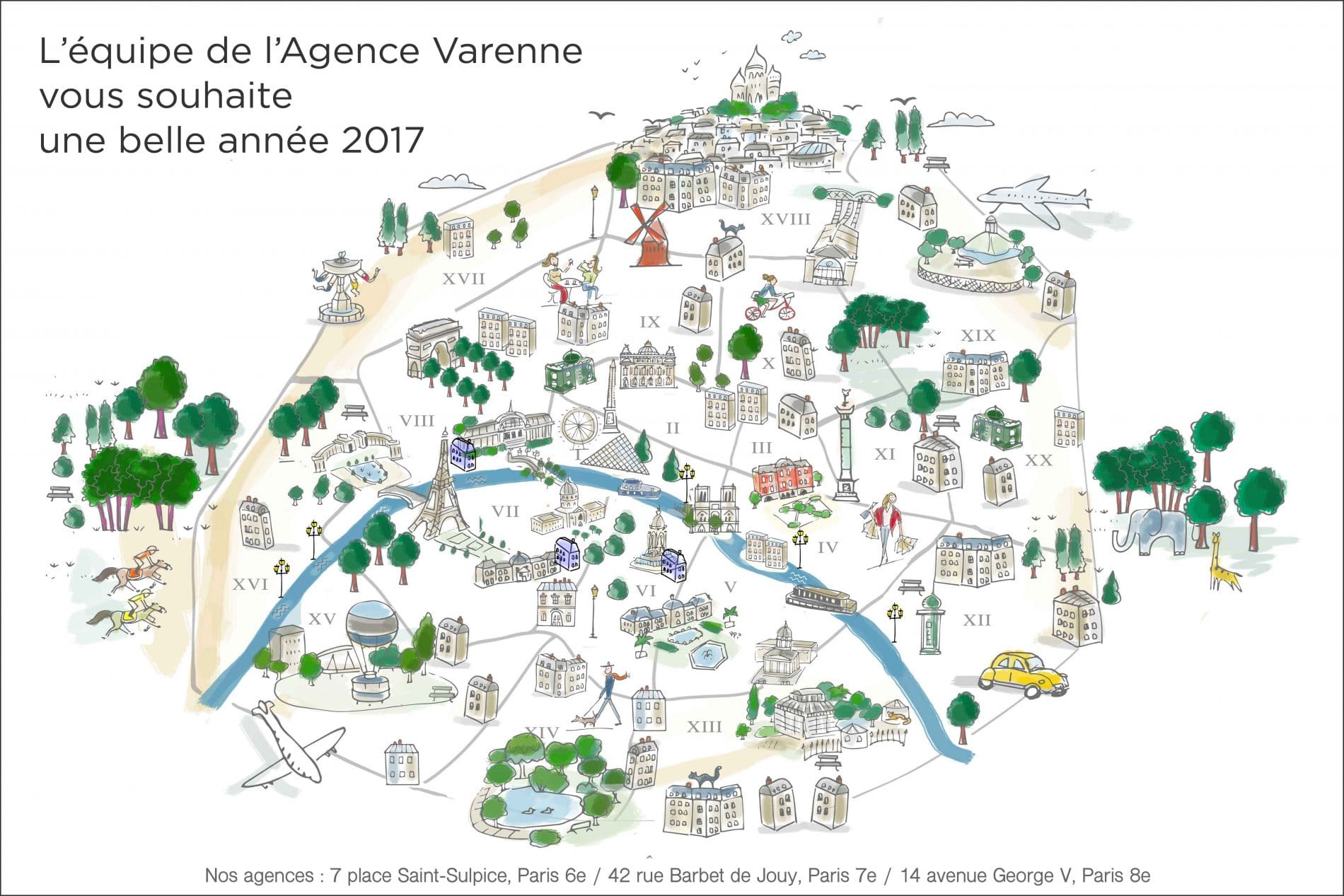

Agence Varenne, an exclusive partner of the Savills group for residential real estate in Paris, celebrated its 25th anniversary during the year 2016 on the

In terms of shopping and a concentration of labels, Paris remains one of the most attractive cities in the World. Recent shopping studies conducted by

For over a year now, the capital has been subject to a rent-control regime that affects both furnished and unfurnished rentals. With a ‘reference rate’

Real estate transactions always come with associated fees. Some payable by the vendor, others by the purchaser, some are split between the two. Here’s a